Research Reveals London's Green Shoots of Recovery

Press release: 17 January 2019

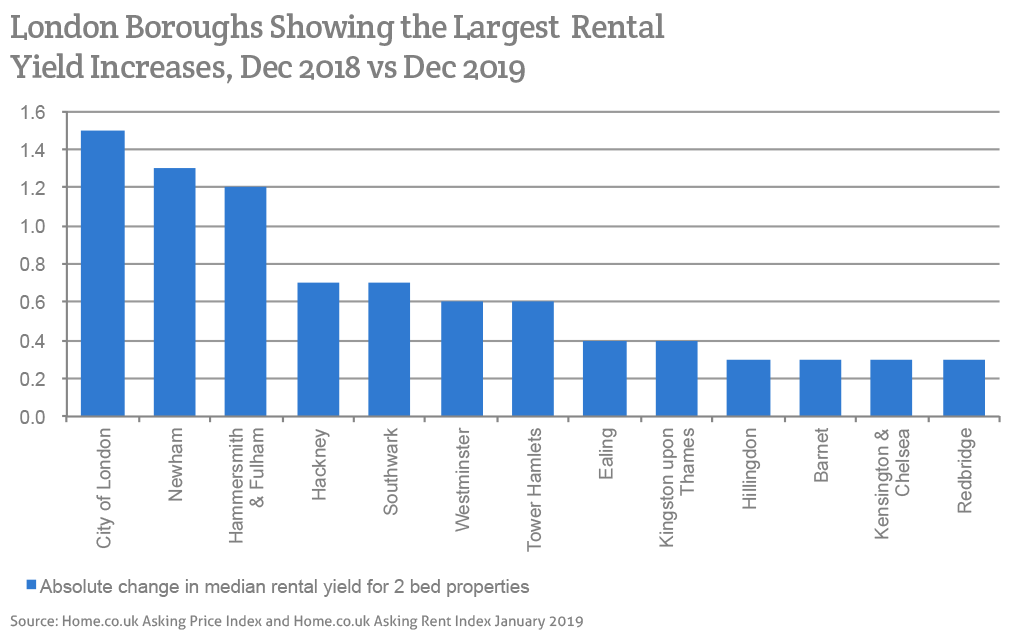

London's house price recovery is set to start in Newham and Hammersmith & Fulham due to booming rental yields in these two boroughs, according to latest analysis by Home.co.uk.

The property website anticipates that the slump in the capital's housing market will come to an end during 2020 due to improving rental yields making property more attractive to investors.

Data from Home.co.uk suggests that this turnaround is likely to start in Newham, where in Dec 2018 the average rental yield was 4.9% compared to 3.6% in Dec 2017. This 1.3% increase is the largest rise in any London borough apart from the City of London, where a 1.5%* rise was observed.

The average rent in Newham is £1,671, up 7.6% on the previous year.

The next hotspot for investors is set to be Hammersmith & Fulham, where rental yields increased by 1.2% from 3.9% in 2017 to 5.1% last year. This promising increase comes amid a 6.2% rise in rents in this West London borough between 2017 and 2018.

Other emerging areas for investors include Hackney and Southwark, where rental yields grew by 0.7% between 2017 and 2018.

Outside of the City of London, Southwark recorded the biggest uplift in rents over 2018, by 20.2%. The average rent in this borough is now £2,532.

There was a 0.6% rise in yields over the same period in the City of Westminster and Tower Hamlets.

Rents in Westminster rose by 12.1% last year and the average rent stands at £5,505, while rents in Tower Hamlets rose by 10.1% and the current average rent is £2,350.

The housing recovery is set to take longer in many outer London boroughs, according to Home.co.uk's data based on rental yield growth.

In Hounslow, Hillingdon, Harrow, Croydon, Waltham Forest, Richmond upon Thames and Barking & Dagenham rental yields stayed the same between 2017 and 2018.

Enfield in North London was the only borough to experience a fall in rental yields over the same period, of 0.2%.

Home.co.uk director Doug Shephard said: "You just can't ignore the London property market's remarkable ability to bounce back. History has shown us time and time again how the UK's leading property market can burst back into growth after a period of correcting prices. The rate of rental yield rises is surely the best analytical tool to pinpoint where the first 'green shoots' will emerge. Whilst it is encouraging that 32 out of 33 London boroughs are showing increased yield year-on-year, it is where they are growing most quickly that is of keen interest to investors. When they approach 6% in 16 or more boroughs, demand in the London sales market will reignite."

Footnote: *Due to the paucity of residential property in the City of London this figure may not be statistically significant.

Notes for Editors

Over the last 29 years, Home.co.uk has become established as a dynamic, innovative and ethical service. By providing the UK's most comprehensive Property Search and Estate Agents directory coupled with detailed House Price analysis, Home.co.uk delivers the real power of the Internet to inform and empower estate agents, homebuyers, renters, landlords and sellers in across the UK.

Contact Details

Email: press@home.co.uk

Phone: 0845 373 3580

Back to Home.co.uk Press